Discover What Builds Your

Credit Score

Your credit score tells the story of your financial lifestyle. It’s built from six main factors that show how you manage money, commitments, and trust.

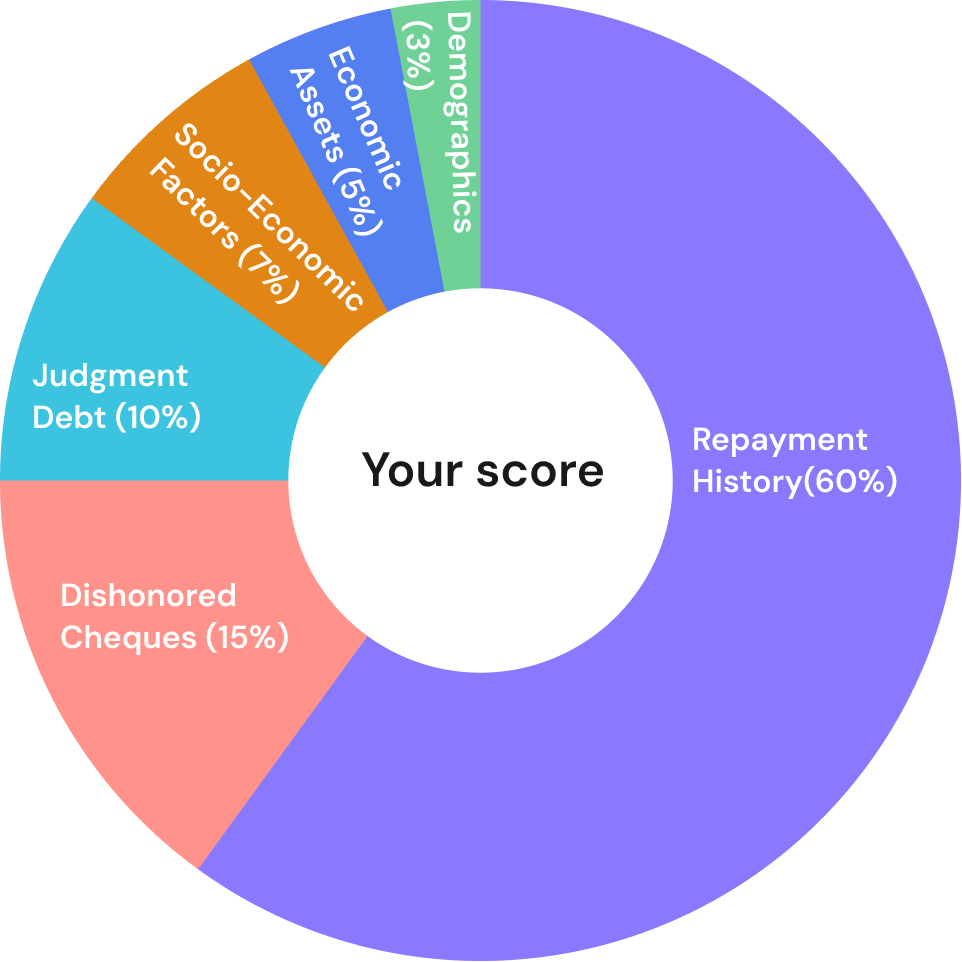

What Builds Your Score

Every decision counts, from the way you repay loans to how you manage your income. These six key factors come together to tell your financial story and show lenders how dependable you are.

Credit Profile & Repayment History (60%)

Consistency Builds Confidence

Credit Profile & Repayment History (60%)

Consistency Builds Confidence

Your payment habits tell the biggest part (60%) of your credit story. Paying on time and keeping balances clear show lenders you are dependable. Each payment builds trust and keeps your score strong.

Dishonored Cheques (15%)

Protect Your Credibility

Dishonored Cheques (15%)

Protect Your Credibility

Bounced cheques make up 15% of your score and can affect how reliable you appear. Clearing them quickly helps rebuild confidence and protect your reputation.

Judgment Debt (10%)

Clearing Debts Strengthens Trust

Judgment Debt (10%)

Clearing Debts Strengthens Trust

Judgement debts make up 10% of your credit score and reflect unpaid financial obligations. Settling them or keeping your record clear helps rebuild trust and improves your standing with lenders.

Socio-Economic Factors (7%)

Stability Shapes Strength

Socio-Economic Factors (7%)

Stability Shapes Strength

A steady job, regular income, and reliable living conditions make up 7% of your score. This shows lenders that you can stay consistent and manage your commitments with confidence.

Economic Assets (5%)

Preparedness Builds Strength

Economic Assets (5%)

Preparedness Builds Strength

Your bank account balance makes up 5% of your score. A healthy bank balance gives the assurance of your ability to meet future commitments and also sustain financial shocks.

Demographics (3%)

Identity That Builds Trust

Demographics (3%)

Identity That Builds Trust

Basic details like age and nationality make up 3% of your score. Verified information confirms your identity and adds confidence to your profile.

Your Credit Score at a Glance

All six components work together to form your complete credit score. Consistency in repayments and responsible financial behavior can significantly improve your rating.

A strong score opens opportunities, from easier approvals to better loan terms. Understanding what shapes it is the first step toward improving it.

Take the First Step to New Financial Possibilities

Get started with myCredit Score and get access to better loan options by knowing your credit score and understanding your credit report.